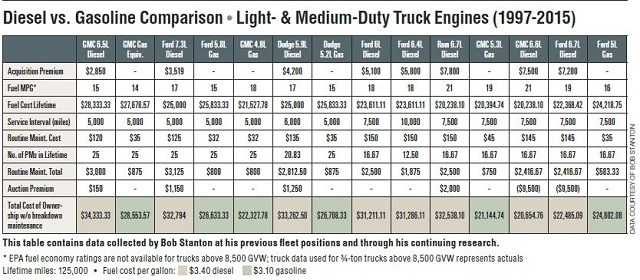

Fifteen years ago, as the fleet management director for Polk County, Fla., I chose to avoid specifying diesel engines in Class 3-6 trucks. At that time, the decision that any vehicle with a gross vehicle weight rating of 19,500 lbs. or lower purchased by Polk County would be powered by gasoline engines only became instantly unpopular. That decision was supported by solid data including a detailed analysis of Polk County’s diesel versus gasoline operating experience that clearly illustrated gasoline engines were a better investment (see “Why Polk County Switched From Diesel to Gasoline Power,” from the March 2000 issue of Automotive Fleet magazine).

At A Glance

Fleet managers can defend the purchase of gasoline Class 3-6 vehicles by:

- Comparing acquisition costs with diesel vehicles

- Showing that diesel fuel's higher cost per gallon negates its slight advantage in fuel economy

- Calculating accurate resale value of both types of vehicles

- Knowing how long vehicles are kept in service and their applications.

A lot has happened to engine technology in 15 years, so it’s time to re-evaluate the data. Has the tide turned in favor of the diesel engine, or does emotion, chutzpah, and the virile attraction of “more power” still drive the diesel decision?

Arguing for Gasoline Vehicles

Fleet managers, the subject matter experts in this area, have a responsibility to ensure tax dollars are spent wisely to maximize the value of every vehicle investment. The fleet manager’s role in the specification process is to ensure every vehicle meets the needs of the mission for which it’s intended and that expenditures are based on fact, readiness, and capability rather than emotion and appetite.

Oftentimes, departments seize the vehicle acquisition season as an opportunity to overreach in vehicle specification demands, driving up costs with little or no compelling justification. The most egregious of these may be the demand for diesel power. In some entities, departments with more clout than their fleet department are seldom challenged effectively enough in this area.

This article provides fleet managers counterpoint arguments they can use to facilitate a more reasoned debate over this decision and help ensure that taxpayers’ investments are better protected by a more deliberate discussion. The same methodology used 15 years ago was used for this analysis, including updated calculations and current operational history.

Miles Per Gallon: Although diesel engines enjoy a sizeable miles per gallon (mpg) advantage over gasoline engines in automobiles, truck engines are a different story. The actual advantage enjoyed by diesel engines in light and medium trucks is less than 2 mpg. In government fleets where daily travel distances are limited, idling is an unfortunate reality, and load requirements can be met equally well with gasoline or diesel engines with little or no impact on mpg; diesel fuel’s higher cost per gallon actually negates its slight advantage in mpg.

Maintenance Costs: Non-fleet “experts” tout that rigid construction and the lack of spark ignition make diesel engines cheaper to maintain than gasoline engines. Fleet managers and maintenance personnel know better. Maintaining diesel engines is made more costly than gasoline engine maintenance by routine maintenance costs and frequency, higher diesel engine hard parts cost (starters, alternators, water pumps, batteries, etc.), selective catalytic reduction (SCR) emission system maintenance and repair, turbocharger maintenance, and other factors not present in gasoline engines. Although no hard data exists, some fleet managers say that diesel vehicles average 2.5 to 4.5 more downtime days per year. This is primarily due to either the lack of parts availability or to a shortage of qualified technicians, either at the dealership or fleet level.

Longevity: Diesel engines last longer. That’s certainly true for over-the-road semi tractors that typically travel 80,000 to 100,000 miles per year. These vehicles are typically expected to operate for half a million miles or more before trade-in or sale. In the past 15 years, at least nine light- and medium-duty diesel iterations have been introduced to the marketplace by Ford, GM, and Fiat Chrysler Automobiles (FCA). Engine families have been rendered obsolete either due to emission control regulations or, in some cases, their own inherent mechanical shortcomings. Few engines in the light/medium class have been around long enough and in great enough numbers to support the longevity claim.

And for government fleets, who really cares about longevity? Government fleets seldom if ever retain a Class 3-6 vehicle longer than eight or 10 years, or for more than 125,000 miles. Further, few governments apply a longer life expectancy to light- and medium-duty diesel vehicles than they apply to gasoline vehicles of similar size. Diesel vehicle longevity is a non-factor in government fleets as both gasoline and diesel vehicles are typically replaced on identical life cycles.

Torque/Horsepower: The belief that diesel vehicles pull better is partially true. Gasoline engines usually have the edge in horsepower, while diesels typically offer higher torque. But in a government fleet application, these attributes are similar in significance to the longevity claim because they don’t matter either. The short-term torque required for government fleet applications, even in severe duty, can be met equally well by a gasoline or diesel engine; gasoline is simply less expensive to purchase and maintain.

Acquisition Cost: This is an often overlooked aspect in the government fleet acquisition dialogue because by the time the narrative extends to the acquisition cost, the operating department has successfully made its case for diesel, and the gasoline alternative is off the table. Fifteen years ago, the government premium paid for the diesel option ranged from $2,200 to $3,000. Today, that premium has risen to about $8,000. How can a department quantify a benefit large enough to justify paying that premium for a diesel engine when an equally capable vehicle can be purchased for less?

Resale Values: Diesel vehicles have higher resale values. The market has realized the value of diesel light and medium trucks, and auction proceed statistics clearly reflect this advantage.

Fleet managers should always consider resale value when purchasing vehicles, but they should be cautious when evaluating the benefit of this advantage. It’s not enough just to target recovering the original acquisition premium at the auction eight to 10 years in the future. Fleet managers who recognize the time value of money understand the implications and responsibility for recovering this premium in real-time dollars. At 3%, in order to recover a $7,800 diesel premium paid originally, fleets and finance departments recognize the premium actually represents more than $9,500 in future value, an auction premium target that’s non-existent when selling gasoline-powered trucks.

What the Studies Say

A widely quoted 2013 study comparing the total cost of ownership (TCO) between gasoline- and diesel-powered vehicles conducted by the University of Michigan Transportation Research Institute concludes that owners of diesel vehicles enjoy a cost advantage over owners of gasoline vehicles. However, the study was heavily slanted toward diesel automobiles from Volkswagen and Mercedes and only covered the first three to five years of ownership, when diesel resale values enjoy a decidedly higher advantage. The study’s conclusions for trucks include the following:

“Vehicles in the medium-size pickup segment have a mixed picture of TCO in the three-year timeframe. The Chevrolet Silverado 2500 saves the owner $3,673 more than the owner of the gas-powered version of the vehicle and the GMC Sierra 2500 owner saves $2,720. The Dodge Ram diesel owner saves only $67 more than the owner of the gas-powered version. The F-250 diesel owner pays an estimated $1,395 more than the owner of the gas-powered version,” the study stated.

It should be noted that this study compared vehicle costs operated by consumers rather than vehicles operated in commercial/fleet related service.

Another well-known and often-quoted source of vehicle cost data is Vincentric. In a 2012 study comparing gasoline vs. diesel vehicles, the company found: “When all costs to own and operate a diesel were taken into account, the average cost of ownership for diesels was $1,203 more than their all-gasoline-powered counterparts, with results assuming an annual mileage of 15,000 over five years.”

These findings were largely unchanged in the company’s follow-on study in 2014.

Ensure the Best Purchase

As new diesel engine families enter the marketplace such as the new 3L available in the Ram 1500 and the 2.9L Duramax soon to be available in the Chevrolet Colorado/GMC Canyon, it will be interesting to watch how these entries affect government buying patterns. Because these entries are not targeted specifically for the medium-duty segment where power is perceived as being only available from diesel engines, they may never enter the government “mainstream” but may instead be used as niche units utilized in limited quantities, unlike their larger 5L and 6L counterparts.

There will always be solid and perfectly acceptable reasons to select and justify diesel engines in government vehicle applications. For instance, diesel fuel may be a safer choice than gasoline for an off-road fire truck (e.g. brush truck) should refueling at a fire scene be needed.

It’s up to the fleet manager, in conjunction with peer discussions and reasoned consideration, to be the voice of reason in the sometimes highly charged specification process. As the subject matter expert, the fleet manager has a responsibility to ensure the best, most capable and cost-effective vehicles are selected, in spite of the wishes and pressure from outside. The fleet manager is the last line of defense in ensuring taxpayers’ vehicle investments are reasonable and represent the best value and return.

Most fleet managers agree the diesel engine option is a less-than-optimal choice and a bad long-term investment. Their role in the specification process is to defend this position from strength with data and commitment.

Writen By Bob Stanton, CPM, CPFP, is an independent fleet consultant and retired public sector fleet manager with 39 years of experience